Candle pattern study 2

Bullish reversal candlestick patterns

Bullish reversal candlestick patterns signify that buyers are momentarily in control.

However, it doesn’t mean you should go long immediately when you spot such a pattern because it doesn’t offer you an “edge” in the markets.

Instead, you want to combine candlestick patterns with other tools so you can find a high probability trading setup (more on that later).

For now, these are 5 bullish reversal candlestick patterns you should know:

- Hammer

- Bullish Engulfing Pattern

- Piercing Pattern

- Tweezer Bottom

- Morning Star

Let me explain…

Hammer

A Hammer is a (1- candle) bullish reversal pattern that forms after a decline in price.

Here’s how to recognize it:

- Little to no upper shadow

- The price closes at the top ¼ of the range

- The lower shadow is about 2 or 3 times the length of the body

And this is what a Hammer means…

- When the market opens, the sellers took control and pushed price lower

- At the selling climax, huge buying pressure stepped in and pushed price higher

- The buying pressure is so strong that it closed above the opening price

In short, a hammer is a bullish reversal candlestick pattern that shows rejection of lower prices.

Now, just because you see a Hammer doesn’t mean the trend will reverse immediately.

You’ll need more “confirmation” to increase the odds of the trade working out and I’ll cover that in details later.

Moving on…

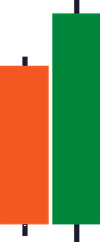

Bullish Engulfing Pattern

A Bullish Engulfing Pattern is a (2-candle) bullish reversal candlestick pattern that forms after a decline in price.

Here’s how to recognize it:

- The first candle has a bearish close

- The body of the second candle completely “covers” the body first candle (without taking into consideration the shadow)

- The second candle closes bullish

And this is what a Bullish Engulfing Pattern means…

- On the first candle, the sellers are in control as they closed lower for the period

- On the second candle, strong buying pressure stepped in and closed above the previous candle’s high — which tells you the buyers have won the battle for now

In essence, a Bullish Engulfing Pattern tells you the buyers have overwhelmed the sellers and are now in control.

And lastly, a Hammer is usually a Bullish Engulfing Pattern on the lower timeframe because of the way candlesticks are formed on multiple timeframes.

Comments

Post a Comment