Candle pattern study 4

Evening Star

An Evening Star is a (3-candle) bearish reversal candlestick pattern that forms after an advanced in price.

Here’s how to recognize it:

- The first candle has a bullish close

- The second candle has a small range

- The third candle closes aggressively lower (more than 50% of the first candle)

And this is what an Evening Star means…

- On the first candle, it shows the buyers are in control as the price closes higher

- On the second candle, there is indecision in the markets as both the selling and buying pressure are in equilibrium (that’s why the range of the candle is small)

- On the third candle, the sellers won the battle and the price closes lower

In short, an Evening Star tells you the buyers are exhausted and the sellers are momentarily in control.

Moving on…

How to find high probability bearish reversal setups

Awesome!

You’ve just learned the different bearish reversal candlestick patterns.

Now, let’s take it a step further and learn how to identify high probability trading setups with it.

Here’s how you do it…

- If the market is trending lower, then wait for a pullback towards Resistance

- If the price pullback towards Resistance, then wait for a bearish reversal candlestick pattern

- If there’s a bearish reversal candlestick pattern, then make sure the size of it is larger than the earlier candles (signalling strong rejection)

- If there’s a strong price rejection, then go short on next candle’s open

- And vice versa for long setups

Here are a few cherry-picked examples:

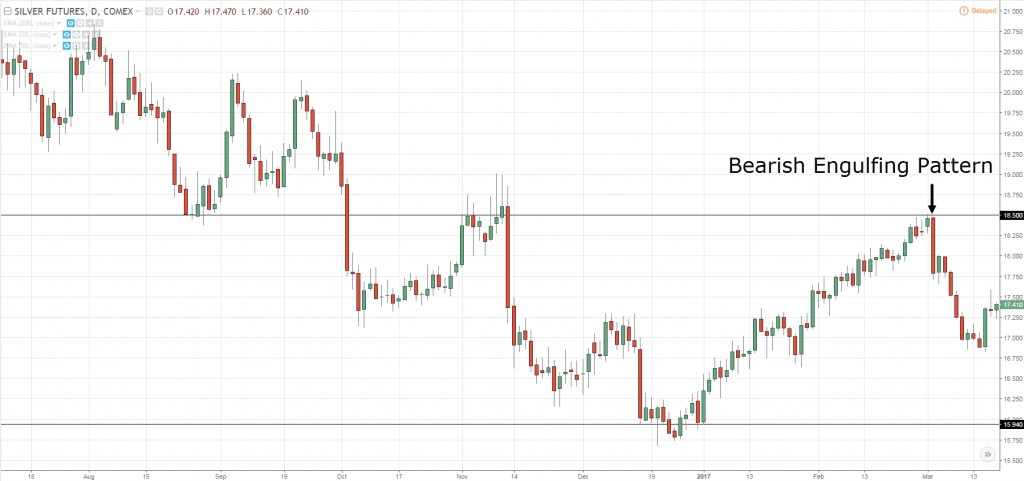

Bearish Engulfing Pattern:

Bearish Engulfing Pattern:

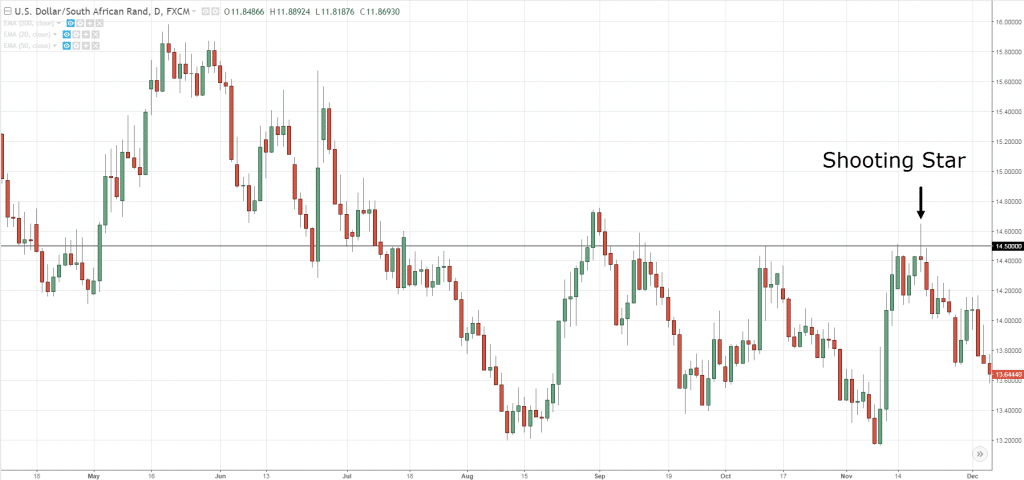

Shooting Star:

Note: There will be losing trades as well and this is not the “holy grail”.

Indecision candlestick patterns

Indecision candlestick patterns signify that both buying and selling pressure is in equilibrium.

And these are 2 indecision candlestick patterns you should know:

- Spinning top

- Doji

Let me explain…

Spinning top

A spinning top is an indecision candlestick pattern that where both buying and selling pressure is fighting for control.

Here’s how to recognize it:

- The candle has long upper and lower shadow

- The candle has a small body

And here’s what a Spinning top means…

- When the market opens, both the buyers and sellers aggressively tried to gain control (which results in upper and lower shadows)

- At the end of the session, neither has gained the upper hand (which results in a small body)

In short, a spinning top shows significant volatility in the market but with no clear winner.

Comments

Post a Comment