Candle patters 3

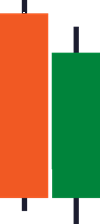

Piercing Pattern

A Piercing Pattern is a (2-candle) reversal candlestick pattern that forms after a decline in price.

Unlike the Bullish Engulfing Pattern which closes above the previous open, the Piercing Pattern closes within the body of the previous candle.

Thus in terms of strength, the Piercing Pattern isn’t as strong as the Bullish Engulfing pattern.

Here’s how to recognize it:

- The first candle has a bearish close

- The body of the second candle closes beyond the halfway mark of the first candle

- The second candle closes bullish

And this is what a Piercing Pattern means…

- On the first candle, the sellers are in control as they closed lower for the period

- On the second candle, buying pressure stepped in and it closed bullishly (more than 50% of the previous body) — which tells you there are buying pressure around

Next…

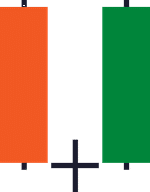

Tweezer Bottom

When I mean Tweezer, I don’t mean the tool you use to pick your nose hair (although it sure looks like it). Instead…

A Tweezer Bottom is a (2-candle) reversal candlestick pattern that occurs after a decline in price.

Here’s how to recognize it:

- The first candle shows rejection of lower prices

- The second candle re-tests the low of the previous candle and closes higher

And this is what a Tweezer Bottom means…

- On the first candle, the sellers pushed price lower and were met with some buying pressure

- On the second candle, the sellers again tried to push price lower but failed, and was finally overwhelmed by strong buying pressure

In short, a Tweezer Bottom tells you the market has difficulty trading lower (after two attempts) and it’s likely to head higher.

Morning Star

A Morning Star is a (3-candle) bullish reversal candlestick pattern that forms after a decline in price.

Here’s how to recognize it:

- The first candle has a bearish close

- The second candle has a small range

- The third candle closes aggressively higher (more than 50% of the first candle)

And this is what a Morning Star means…

- On the first candle shows, the sellers are in control as the price closes lower

- On the second candle, there is indecision in the markets as both the selling and buying pressure are in equilibrium (that’s why the range of the candle is small)

- On the third candle, the buyers won the battle and the price closes higher

In short, a Morning Star tells you the sellers are exhausted and the buyers are momentarily in control.

Moving on…

How to find high probability bullish reversal setups

Great!

You’ve learned the different bullish reversal candlestick patterns.

Now, let’s take it a step further and learn how to identify high probability trading setups with it.

Recall:

You don’t want to trade any candlestick patterns in isolation because it doesn’t offer an “edge” in the markets.

So here’s how you do it…

- If the market is trending higher, then wait for a pullback towards Support

- If the price makes a pullback towards Support, then wait for a bullish reversal candlestick pattern

- If there’s a bullish reversal candlestick pattern, then make sure the size of it is larger than the earlier candles (signalling strong rejection)

Here are a few cherry-picked examples:

Morning Star:

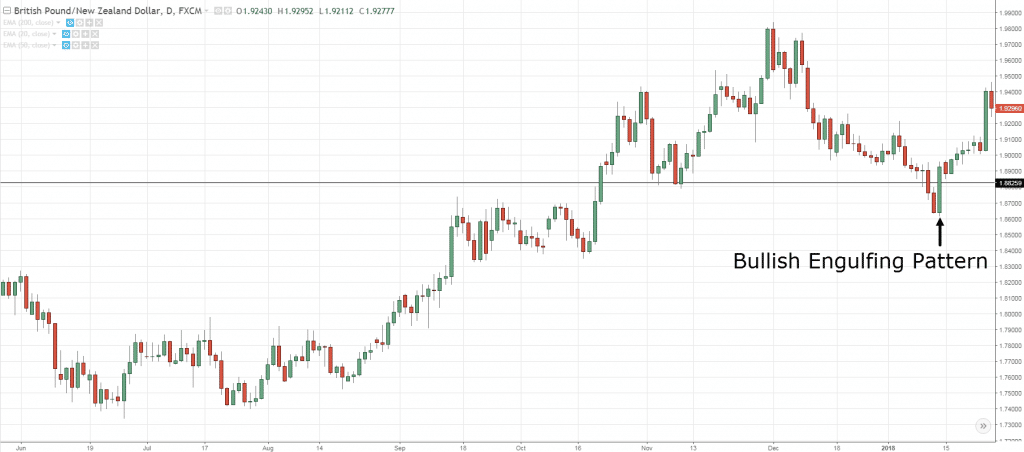

Bullish Engulfing Pattern:

Bullish Engulfing Pattern:

Note: There will be losing trades as well and this is not the “holy grail”.

Now, let’s move on…

Bearish reversal candlestick patterns

Bearish reversal candlestick patterns signify that sellers are momentarily in control.

Likewise, it doesn’t mean you should go short immediately when you spot such a pattern because it doesn’t offer you an “edge” in the markets.

Instead, you want to combine candlestick patterns with other tools so you can find a high probability trading setup.

For now, these are 5 bearish reversal candlestick patterns you should know:

- Shooting Star

- Bearish Engulfing Pattern

- Dark Cloud Cover

- Tweezer Top

- Evening Star

Let me explain…

Shooting Star

A Shooting Star is a (1- candle) bearish reversal pattern that forms after an advanced in price.

Here’s how to recognize it:

- Little to no lower shadow

- The price closes at the bottom ¼ of the range

- The upper shadow is about 2 or 3 times the length of the body

And this is what a Shooting Star means…

- When the market opens, the buyers took control and pushed price higher

- At the buying climax, huge selling pressure stepped in and pushed price lower

- The selling pressure is so strong that it closed below the opening price

In short, a Shooting Star is a bearish reversal candlestick pattern that shows rejection of higher prices.

Now, just because you see a Shooting Star doesn’t mean the trend will reverse immediately.

You’ll need more “confirmation” to increase the odds of the trade working out and I’ll cover that in details later.

Moving on…

Bearish Engulfing Pattern

A Bearish Engulfing Pattern is a (2-candle) bearish reversal candlestick pattern that forms after an advanced in price.

Here’s how to recognize it:

- The first candle has a bullish close

- The body of the second candle completely “covers” the body first candle (without taking into consideration the shadow)

- The second candle closes bearish

And this is what a Bearish Engulfing Pattern means…

- On the first candle, the buyers are in control as they closed higher for the period

- On the second candle, strong selling pressure stepped in and closed below the previous candle’s low — which tells you the sellers have won the battle for now

In essence, a Bearish Engulfing Pattern tells you the sellers have overwhelmed the buyers and are now in control.

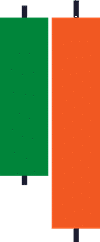

Dark Cloud Cover

A Dark Cloud Cover is a (2-candle) reversal candlestick pattern that forms after an advanced in price.

Unlike the Bearish Engulfing Pattern which closes below the previous open, the Dark Cloud Cover closes within the body of the previous candle.

Thus in terms of strength, the Dark Cloud Cover isn’t as strong as the Bearish Engulfing pattern.

Here’s how to recognize it:

- The first candle has a bullish close

- The body of the second candle closes beyond the halfway mark of the first candle

- The second candle closes bearish

And this is what a Dark Cloud Cover means…

- On the first candle, the buyers are in control as they closed higher for the period

- On the second candle, selling pressure stepped in and it closed bearishly (more than 50% of the previous body) — which tells you there are selling pressure around

Next…

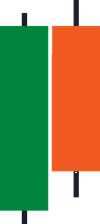

Tweezer Top

A Tweezer Top is a (2-candle) reversal candlestick pattern that occurs after an advanced in price.

Here’s how to recognize it:

- The first candle shows rejection of higher prices

- The second candle re-tests the high of the previous candle and closes lower

And this is what a Tweezer Top means…

- On the first candle, the buyers pushed the price higher and were met with some selling pressure

- On the second candle, the buyers again tried to push the price higher but failed, and was finally overwhelmed by strong selling pressure

In short, a Tweezer Top tells you the market has difficulty trading higher (after two attempts) and it’s likely to head lower.

Comments

Post a Comment