Candle patters 5

Doji

A Doji represents indecision in the markets as both buying and selling pressure are in equilibrium.

Here’s how to recognize it:

- The candle’s open and close are around the middle of the range

- The upper and lower shadows are short and about the same length

Although Doji is an indecision candlestick pattern, there are variations with different significance.

They are:

- Dragonfly Doji

- Gravestone Doji

I’ll explain…

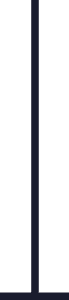

1. Dragonfly Doji

Unlike a regular Doji which open and close near the middle of the range, the Dragonfly Doji open and close near the highs of the range with long lower shadow.

This tells you there is a rejection of lower prices as buying pressure stepped in and pushed the market higher towards the opening price.

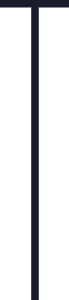

2. Gravestone Doji

Unlike a regular Doji which open and close near the middle of the range, the Gravestone Doji closes open and close near the lows of the range with long upper shadow.

This tells you there is a rejection of higher prices as selling pressure stepped in and pushed the market lower towards the opening price.

Moving on…

Continuation candlestick patterns

Continuation candlestick patterns signify the market is likely to continue trading in the same direction.

And if you’re a trend trader, these candlestick patterns present some of the best trading opportunities out there.

So here are 4 continuation patterns you should know:

- Rising Three Method

- Falling Three Method

- Bullish Harami

- Bearish Harami

Let me explain…

Rising Three Method

The Rising Three Method is a bullish trend continuation pattern that signals the market is likely to continue trending higher.

Here’s how to recognize it:

- The first candle is a large bullish candle

- The second, third and fourth candle has a smaller range and body

- The fifth candle is a large-bodied candle that closes above the highs of the first candle

And here’s what a Rising Three Method means…

- On the first candle, it shows the buyers are in domination as they closed the session strongly

- On the second, third, and fourth candle, buyers are taking profits which led to a slight decline. However, it’s not a strong selloff as there are new buyers entering long at these prices

- On the fifth candle, the buyers regain control and pushed the price to new highs

Note: If you’re familiar with western charting, you’d realized the Bullish Flag and Rising Three Method pretty much mean the same thing.

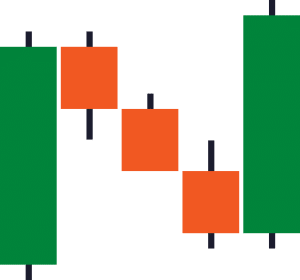

Falling Three Method

The Falling Three Method is a bearish trend continuation pattern that signals the market is likely to continue trending lower.

Here’s how to recognize it:

- The first candle is a large bearish candle

- The second, third and fourth candle has a smaller range and body

- The fifth candle is a large-bodied candle that closes below the lows of the first candle

And here’s what a Falling Three Method means…

- On the first candle, it shows the sellers are in domination as they closed the session strongly lower

- On the second, third, and fourth candle, sellers are taking profits which led to a slight advanced. However, it’s not a strong rally as there are new sellers entering short at these prices

- On the fifth candle, the sellers regain control and pushed the price to new lows

Next…

Bullish Harami

Here’s the deal:

Most trading websites or books will tell you the Bullish Harami occurs after a decline in price.

But I can’t agree.

This is one of those things you must use common sense to filter out the BS out there.

Think about this:

A downtrend is created using the prices of the few hundred candlesticks.

Do you think it will reverse because a Bullish Harami is formed?

Unlikely.

Instead, the Bullish Harami works best as a continuation pattern in an uptrend.

It signals the buyers are “taking a break” and the price is likely to trade higher.

Moving on…

Here’s how you recognize a Bullish Harami:

- The first candle is bullish and larger than the second candle

- The second candle has a small body and range (it can be bullish or bearish)

And here’s what a Bullish Harami means…

- On the first candle, it shows strong buying pressure as the candle closes bullishly

- On the second candle, it shows indecision as both buying and selling pressure is similar (likely because of traders taking profits and new traders entering long positions)

Note: You can treat the Harami as an Inside Bar. They mean the same thing and can be traded in a similar context.

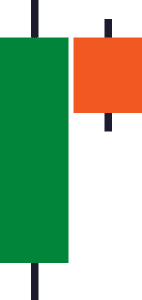

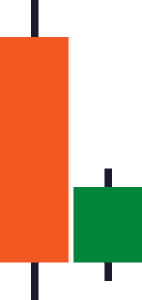

Bearish Harami

A bearish Harami works best as a continuation pattern in a downtrend.

It signals the sellers are “taking a break” and the price is likely to trade lower.

Here’s how you recognize a Bearish Harami:

- The first candle is bearish and larger than the second candle

- The second candle has a small body and range (it can be bullish or bearish)

And here’s what a Bearish Harami means…

- On the first candle, it shows strong selling pressure as the candle closes bearishly

- On the second candle, it shows indecision as both buying and selling pressure is similar (likely because of traders taking profits and new traders entering short positions)

Let’s move on…

Comments

Post a Comment